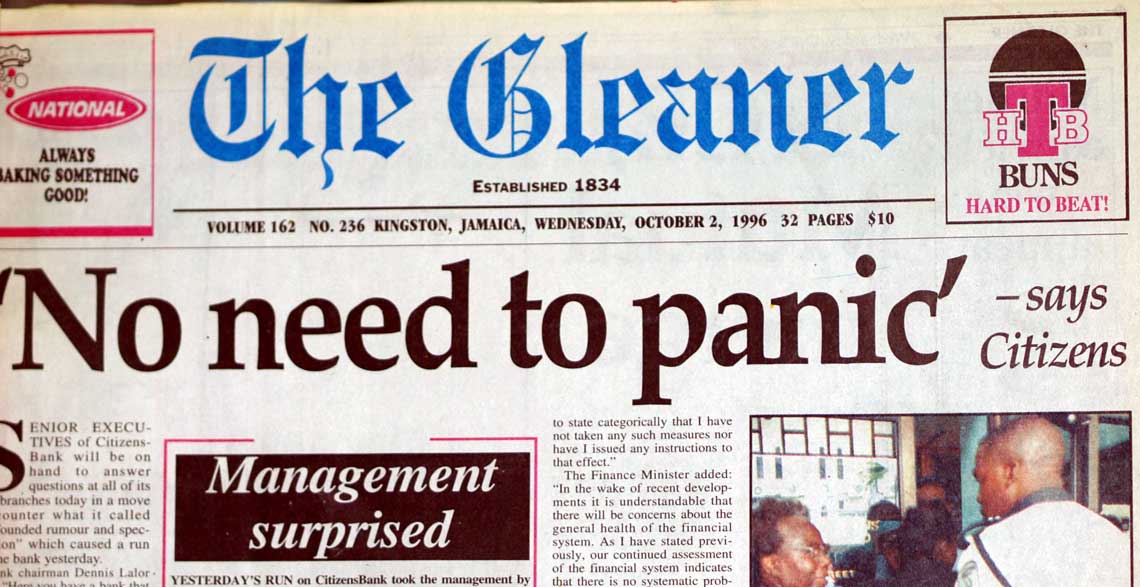

Sunday | October 6, 1996

It finally happened. Panic followed rumour, in a general atmosphere of distrust of our financial system. The widespread, concentrated run on Citizens Bank was perhaps not predictable, it was however not surprising.

Earlier rumours suggested it would be another bank, but local bank it was. Recently, particularly in the past few months indigenous banks, locally created and owned banks, have come under increasing scrutiny by the public. No doubt this general tendency to mistrust some elements of our financial system stems from the past situations at Blaise, Century and the general uncertainty associated with the system, fueled by pronouncements on the sector by people who enhance their positions by being counted among those very few who “know how tings guh”! Who are important enough to be in the inner circles!

But there was and is, quite a lot going on in the society to create a very fertile ground for this panic reaction which we have read so much about but never perhaps thought we would experience. Do you remember the advert on TV merely moments before Century was taken over by the Minister?

It showed you the CEO, beautiful banking hall, etc. All puff! And people respond to these things. Further, have you noticed how at this time our creative advertisers are convincing everyone in the financial sector to push ‘Safety’ in the hard sell of their products? This plays on people’s minds; they mistrust those in whom they would once have placed trust.

In this connection there are some comments that the former Governor of the Bank of Jamaica made in a speech to the Life Insurance Companies Association on March 18. When I read the speech, I wondered why he waited until his job was done, to say the important things that should have been established when it had merely begun! Here are a few of his words:

" … no matter how much effort is made to improve the legislative framework, and how much human and financial resources are devoted to strengthening the supervisory process, there will always be one essential element that is required, if the people of Jamaica are to have confidence in their financial system. This element is integrity … not everyone in the financial system shares the same philosophy … some have a confused view of what is meant by fiduciary responsibility. They have exhibited a tendency to believe that depositors’ money is their money and have in the process lent to themselves large sums of money to purchase real estate or other assets in pursuit of their own self-ambition. They have repeatedly violated the law in full cognizance of it and quite often they have been supported in their endeavours by some members of the legal and accounting profession.” [Jamaica Observer, March 18 1996; emphases added]

Former Bank of Jamaica Governor Jacques Bussières in the years leading up to the financial crash was concerned about capital adequacy among indigenous Financial Services groups. © 1993 The Gleaner

Former Bank of Jamaica Governor Jacques Bussières in the years leading up to the financial crash was concerned about capital adequacy among indigenous Financial Services groups. © 1993 The Gleaner

I cut this piece from the paper to comment on it and didn’t at the time. I presumed he was speaking of Blaise and Century. The point is why did Mr. Bussières not act earlier on this information he had? Was he prevented by his political masters? Did Mr. Bussières believe that in a place as small as Jamaica other people did not know or have a whiff of what was going down?

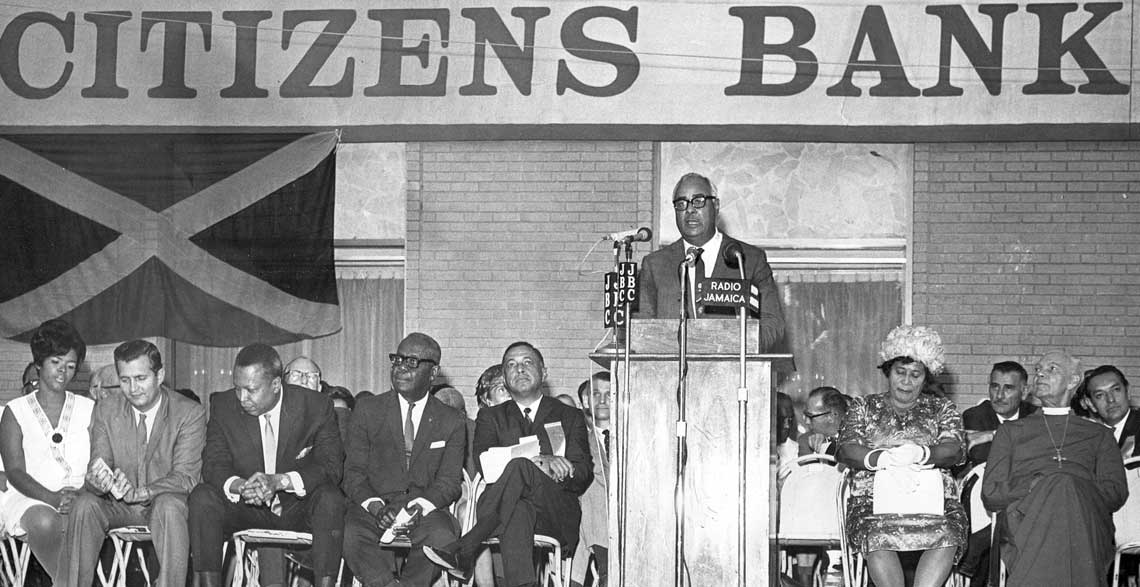

Citizens Bank is rather unfortunate, for it was not really a deserving candidate for the action its depositors took. But as I have been at pains to point out in previous columns, the incestuous relationships that have developed, especially among our indigenous operations in the financial system is a dangerous thing. Optimism: Launching Citizens Bank in 1968, Hon. Russell Graham, Custos of St. Andrew and Board Chairman of the bank speaks of its intention to “try in every way to improve the economy”. Front row from left: Mrs. Seaga, the Hon. Edward Seaga, Minister of Finance and Planning, Prime Minister, the Hon. Hugh Shearer, Governor General, Sir Clifford Campbell, Mr. William F. Smith, a director of the Bank and master of ceremonies, Lady Campbell and the Anglican Bishop of Jamaica, the Rt. Rev. J. C. Swaby. © 1968 The Gleaner

Optimism: Launching Citizens Bank in 1968, Hon. Russell Graham, Custos of St. Andrew and Board Chairman of the bank speaks of its intention to “try in every way to improve the economy”. Front row from left: Mrs. Seaga, the Hon. Edward Seaga, Minister of Finance and Planning, Prime Minister, the Hon. Hugh Shearer, Governor General, Sir Clifford Campbell, Mr. William F. Smith, a director of the Bank and master of ceremonies, Lady Campbell and the Anglican Bishop of Jamaica, the Rt. Rev. J. C. Swaby. © 1968 The Gleaner

John and Jane Public have come to associate these institutions with ‘Big Men’ who play fast and loose with people’s money, who live high life, who steal clients’ ideas and projects to give to their friends, who seek to gain advantage by trickery, who couldn’t care any less about their money and potential plight. It is this atmosphere which provides the fumes in which the rumour could ignite.

They feel Scotiabank and CIBC are controlled from Canada so “dem caan do that!” Citibank is Uncle Sam, safe as the front pew in the Church! It is our indigenous institutions that will have to struggle to overcome the reputations they have garnered, wrongly or rightly. This requires candour in information and advertising, moreso integrity in operations. Government must set limits to the kinds of operations our financial institutions are allowed to engage in. An army of regulators will not solve the problem. Bussières was right, only too late and with no action.