Friday | August 15, 2008

“Dad, it’s not a matter of statistics or probabilities. It’s the philosophy!” Man, need I say I felt proud! In conversation with my sons I was being set straight. Discussing a hypothetical: should a parking garage floor improperly tied into surrounding structures be demolished and rebuilt?

The general question was whether such problems need to be fixed, at enormous expense, if the likelihood of a precipitating event stands less than a one per cent chance of happening. The engineering answer is yes. ‘Design philosophy’ emphasizes avoidance of catastrophic failure — the event of shatter or rupture in an unidentified weakness.

Tell tale signs

At the time I felt compelled to note this for discussing failure in our financial system. That was several years ago. My scribbled note was misplaced but I stumbled upon it as I set about writing this piece on collapse of alternative investment schemes.

If a beam can possibly fail, its design should be such that it bends, buckles, showing telltale signs of impending failure prior to actual collapse. Emergency action avoids loss of life. Design philosophy for safe functioning looms large. In vibrant capitalism the continuous process dubbed ‘creative destruction’ maintains permanent renewal. Old systems, products and procedures are ‘destroyed’ and abandoned for newer, more efficient, technically superior alternatives. If this process stalls the economic system cannot grow with vigour, indeed it may atrophy.

China not capitalist

US commentators are fond of observing that China is not capitalist. Obviously they are in great measure correct. Yet when we consider a system so vast and for China, changing so rapidly, the idea of economic dualism or an economy on a Tri-Rail may be more useful and instructive analogies. Collective decision making prevails alongside private profit motive. Rural peasant agriculture survives even as high-tech automated factories bloom.

For the Olympics government decree shuts down Beijing construction sites. But the financial system is different. Sovereign wealth fund may exist, managed not by communist committee decree but capitalist management principles. Apparent contradictions flourish. We face a strange, hitherto unknown and hence unique mix of decision making controls over economic activity.

I raise this matter of China to highlight the universality of financial sector regulation—the one area in which ideology can play no useful role: control over the financial system. There are very good reasons for this. We can state an axiom: capitalism necessitates prudential regulation of the financial system. Its absence or imprudent practice allow and in part cause crises and crashes. I find no historic evidence to counter this proposition.

So we come to design philosophy as it relates to the country’s financial infrastructure. Design should embody forewarning — tell-tale signs of impending failure prior to the event. Yet this is not a sufficient requirement. Signs of potential failure require the offending ‘element’ to be demolished and abandoned or reconstructed.

Legal lag

Archaic laws coupled with inappropriate regulatory design and delayed action allowed the mid-1990s indigenous financial services sector problems to metastasize into meltdown. Similarly legal lag, inaction and delay contributed to meltdown of people’s savings in alternative investment schemes — no denial of greed and gullibility. But the matter of regulation and counter measures is not as simple as it would seem.

Cash Plus Principal Carlos Hill, smooth operator, in glory days of 10% per month interest, before being accused of fraud, addressing a crowd of potential ‘lenders’ at Merl Grove High School Auditorium in St. Andrew. © 2007 The GleanerRegulatory design transforms to conventions, sets of laws and regulations governing operating conditions and procedures for maintaining healthy financial services. Bank of Jamaica inspects banks, reviews key ratios, loans, loan documentation and collateral covering indebtedness.

Cash Plus Principal Carlos Hill, smooth operator, in glory days of 10% per month interest, before being accused of fraud, addressing a crowd of potential ‘lenders’ at Merl Grove High School Auditorium in St. Andrew. © 2007 The GleanerRegulatory design transforms to conventions, sets of laws and regulations governing operating conditions and procedures for maintaining healthy financial services. Bank of Jamaica inspects banks, reviews key ratios, loans, loan documentation and collateral covering indebtedness.

Factors

It looks at a host of other factors to determine banks’ health status. Upon discovery of disquieting vital signs, it intervenes. Proposed remedial action command compliance on pain of being struck out — all done in private utmost confidential discourse. Our Financial Services Commission does the same for non-bank operators — alternative investment schemes naturally fall here.

Pro-Cash Plus supporters bearing placards outside Half Way Tree Courthouse reveal greater trust and confidence in Cash Plus CEO Carlos Hill, than Government! © 2008 The Gleaner

Pro-Cash Plus supporters bearing placards outside Half Way Tree Courthouse reveal greater trust and confidence in Cash Plus CEO Carlos Hill, than Government! © 2008 The Gleaner

So why are policing and regulating such schemes not straightforward as might at first appear? First, existing law constrains policy and official action. Enterprising innovators participating in ‘creative destruction’ and those knowingly skirting the law conceive of, and create new instruments in financial intermediation, often exploiting the regulatory architecture’s undetected gaps and loopholes. Innovation is good and investment clubs fall into this category. But legislation lags behind.

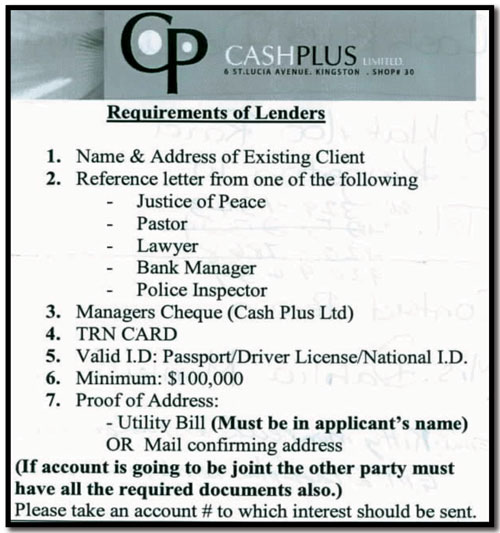

Second, financial stability requires confidence that regulatory missteps can easily shake and momentarily destroy. A moment is all that is necessary to create panic. These schemes, discussed in the press, in salons, bar Instruction slip for ‘lenders’ wishing to deposit money with the Cash Plus Alternative Investment Scheme. To circumvent regulatory legislation governing deposit-taking institutions, Cash Plus defined ‘depositors’ as ‘lenders’. Requirements for acceptance of a ‘Lender’ mimicked those of commercial banks - building an image of authenticity. Potential clients all but mobbed the scheme’s offices at St. Lucia Avenue, New Kingston. Interestingly the location was former Island Life Insurance Company Head Office premises, financing and construction of which - costing in excess of J$1 billion - in part led to that institution's collapse in mid-1996.ber shops, bars and even at church, suggested a consensus which peoples’ participation rates confirm: they trusted them and their operators more than government and conventional financial intermediaries. Many appeared to feel big profits of conventional financial institutions somehow reflected their being short changed — savings returns were too low. Alternative schemes provided Robin Hood’s morality, returns and distribution.

Instruction slip for ‘lenders’ wishing to deposit money with the Cash Plus Alternative Investment Scheme. To circumvent regulatory legislation governing deposit-taking institutions, Cash Plus defined ‘depositors’ as ‘lenders’. Requirements for acceptance of a ‘Lender’ mimicked those of commercial banks - building an image of authenticity. Potential clients all but mobbed the scheme’s offices at St. Lucia Avenue, New Kingston. Interestingly the location was former Island Life Insurance Company Head Office premises, financing and construction of which - costing in excess of J$1 billion - in part led to that institution's collapse in mid-1996.ber shops, bars and even at church, suggested a consensus which peoples’ participation rates confirm: they trusted them and their operators more than government and conventional financial intermediaries. Many appeared to feel big profits of conventional financial institutions somehow reflected their being short changed — savings returns were too low. Alternative schemes provided Robin Hood’s morality, returns and distribution.

Churches

The fact that churches seem to have facilitated participation adds even greater credence to this view. Extant legislation allowed neither inspection nor regulation. Politically too, outlawing these schemes would always be difficult. How can you tell someone getting 10 per cent per month on a deposit consistently for six straight months that the operation is unsustainable and government shall shut it down? What kind of advance public relations blitz will be required? Will it succeed? No one knows. Failure and collapse is perhaps the only sure way to force people to face reality.

But at day’s end these situations require bold, courageous decisions. Collective pain inflicted by inaction, dwarfs the fallout of controversial, unpopular but timely enforcement of emergency legislative and other action.